The news that Spotify’s mobile app is now available for the Android platform, coupled with an anticipated Autumn US launch, are both part of the music service’s inexorable rise and media interest. Spotify undoubtedly has momentum and potential in abundance. But, even without considering the issue of cash burn, it is also important to keep a sense of scale. Spotify has done a great job of acquiring a sizeable audience after a short period of time, but needs many users more before it can be considered on a par with some more established services that get a lot less attention (these days at any rate).

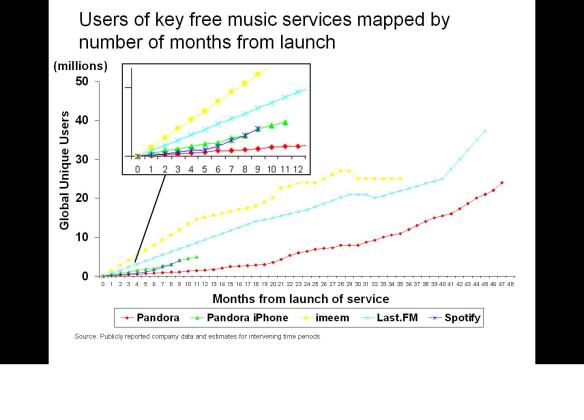

In the chart below I have mapped the number of users of Spotify and a number of other key free music services, each from launch. What is clear is that Spotify has made a solid start is growing at a stronger rate than Pandora was at the same stage. If Spotify ever reaches Pandora’s scale and business model viability, it will rightly be considered a success.

But it is also clear that other services like Last.FM and imeem grew more quickly. And just to put the absolute scale of Spotify into perspective, the Pandora iPhone app alone is mapping almost exactly in line with Spotify’s entire user base. (No coincidence of course that Spotify see the iPhone app as a crucially important ticket to further success).

So what can we conclude from these numbers?

- Extrapolating Spotify’s early user growth suggests that if it is sustained it could reach the 20-30 million user range within 2 years

- A US launch will significantly accelerate audience growth (all of the other services mapped here have US reach. imeem and Pandora have reached their scale in the US alone)

- Spotify will need to accelerate its revenue model maturation if it is going to be able to sustain this projected level of growth.

The last point is key. All of the other services in the chart have had to deal with the challenge of audience cost sustainability:

- imeem has had well publicized financial difficulties with WMG writing off millions of debt

- Last.FM recently closed its free service to countries it couldn’t operate in profitably

- Pandora closed its non-US operations when it couldn’t strike deals with rights owners that would enable it to operate profitably in international markets. Pandora has long focused on building financially sustainable audiences, a strategy echoed by We7 in the UK.

Spotify has run a fast first lap, but it is a very, very long race.

Interesting points, agreed sustainability is key.

I would be interested in two other pieces of data.

1. How does the chart look if you allow for regional availability – since Spotify is only available in some territories. Otherwise the figures are not really comparable.

2. What about if you look at usage rather than users? I’ve signed up for lots of these services but rarely use them, whereas Spotify I use all the time because it is so well done.

Tim

Interesting stats, but it does seem a bit unfair to compare US vs. EU pickup rates (unless figures are e.g. percentage of total possible users).

Spotify is not yet available officially on Android: perhaps it’s the 3rd-party Droidify app you refer to? This app was banned by Spotify within a day of its release, even though users were signing up to Spotify premium to use it. Any idea why Spotify would want to kill it?

With regards to regional comparisons, the importance of the US market as an addressable audience is absolutely key. So when Spotify is available in the US there will be better comparisons. But even then the comparisons will only work so far. Pandora and Last.FM are predominately radio-like experiences, not the full on demand Spotify experience.

A useful comparative metric in the meantime is penetration of the online population: Pandora currently has 10% US penetration, Spotify currently has 3% penetration across its available territories.

With regards to the Droidify app – I’d expect the reason is to take a free app out of the market the provides similar functionality to that which Spotify users will need to pay for.

Not sure you can extrapolate growth from prior history. At some point, these services are competing for the same ear-time.

One thing is for sure — all eyes are on Spotify at the moment. I personally love the service, but am curious as to whether it will play a role in establishing a meaningful revenue stream for artists.

Which is why, in a totally non-spammy way, I wanted to let you know that Spotify founder Daniel Ek is coming to speak at my org Future of Music Coalition’s upcoming Policy Summit in DC (Oct. 4-6).

If you’re interested in Spotify developments, it might be a good opportunity to hear from the horse’s mouth. I’m pretty psyched — hope I can get a few questions in, myself. More info:

http://futureofmusic.org/events/future-music-policy-summit-2009

Pingback: Tim Anderson’s ITWriting - Tech writing blog » Apple, Spotify, Google and iPhone: how to get into App Store

If you want to Run Your Marathons Faster and Run Faster Marathon times I suggest you check out this video on training for a marathon in 100 days. It’s a great way to train.