It appears to be the time of year for music forecasts. Today MIDiA is proud to announce the release of our global music forecasts report, which marks the tenth year of us doing these! The full 75+ page report and 40+ page datasheet for 45+ countries and regions, is available to MIDiA clients and for purchase here. And for the first time, we have also created a public page for the forecasts where you can watch a video of the music forecasts team talking about some of the big themes, and there’s a free summary report to download too. Of course, data without context are just numbers, so here follows some of the key themes and thinking that underpins MIDiA’s music forecasts.

First off, just to showcase our ‘creds’, this is how our forecast from last year for 2023 total revenues lined up with the actual figure. Yes, you read right, our forecast was just half a percentage point off from what the actual number proved to be! And going back further than that, the average variance from 2019 to 2023 for our forecasts for 2023 streaming revenues was just 6% from the actual figure. So, hopefully, that will give you some confidence that we know what we’re talking about 😊

With that little flex out of the way, onto this year’s edition…

2023 was a positive year for the global recorded music market. Crucially, it was a year in which the industry demonstrated its ability to diversify revenue growth with strong performance across not only streaming, but also physical, performance and expanded rights. Streaming remains the beating heart of revenue and will remain so for the forecast period covered in the report, but it now exists as one part of a robust, diversified revenue portfolio. The strong growth in 2023 should not be taken lightly. It came against the backdrop of uncertainty in the wider global economy and geo-political turmoil. What is more, subscriber growth continued at a good pace, despite the first wave of major price increases in the history of music subscriptions.

All these factors point to a recorded music market that has demonstrated its inherent consumer appeal, even in challenging times.

However, it would be wrong to assume that this is an industry without its fair share of challenges. The proliferation of new artists with the democratisation of the means of production and distribution has put the industry’s ecosystem under a level of strain it was not designed for. Bigger artists aren’t getting as big as they once were (the reality distortion field that is Taylor Swift aside) and smaller artists are struggling to make streaming pennies add up. Meanwhile, everyone is struggling to cut through and DSPs, social platforms and rightsholders are bickering over how much music is worth. All of these factors of course, are not isolated events. They are inter-dependent and represent the birthing of a new era for the industry. A coming bifurcation of the industry between the traditional streaming-centred business on one side, and the continued rise of a more social and fan-focused business on the other. And we’ve got a number for that. In fact, we’ve got a lot of numbers for that, in the shape our first ever bifurcation forecast in the report.

We have also for the first time forecasted expanded rights, which along with our non-DSP and physical formats forecasts, mean that we also have a fan economy forecast, to help paint a picture of what tomorrow’s, transformed music business will look like.

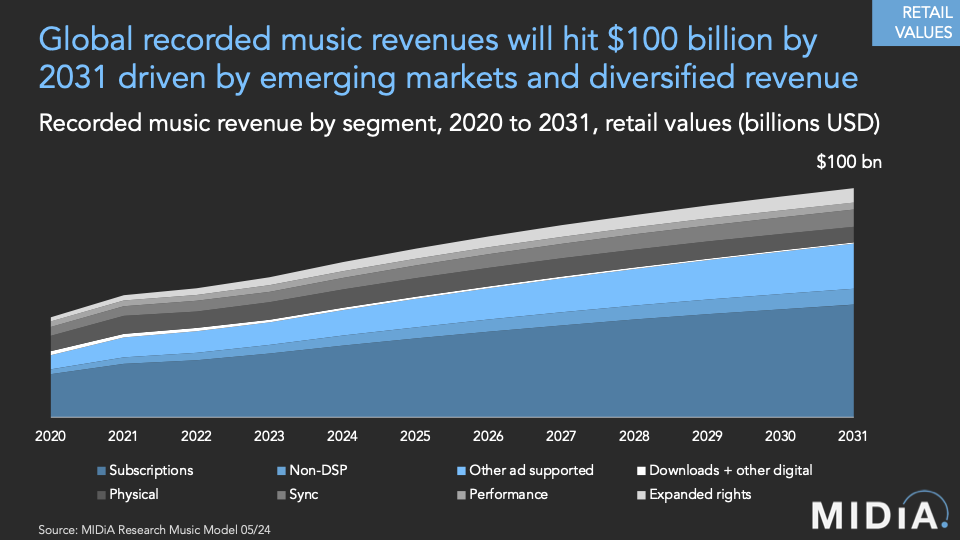

When you add these together with all the other components of the recorded music business, music industry revenues will reach $100 billion by 2031 in retail terms. Recorded music growth will be defined by strong performance across most formats, however streaming will add most revenue between 2023 and 2031 to reach three quarters of all revenues. Global music subscribers hit 737.9 million in 2023, adding more subscribers than in 2022. Music subscribers will break the one billion mark in 2027 and continue to grow, driven by Global South markets.

One of the key themes in the report, as reflected by its title, is the rise of the Global South. Global South markets will drive a growing share of growth, especially in user terms, though western markets will still dominate global revenues due to higher ARPU. Perhaps most significantly of all, China will become the second largest recorded music market by 2031. The US will remain the top subscription revenue market in 2031 due to high ARPU, but China will become second due to subscriber growth.

ARPU – it’s not just about price

With streaming being the majority of revenues, now and by 2031, ARPU is fast becoming the music industry’s key metric. Indeed, one of the key conversation points around streaming is price increases and their ARPU impact. Unfortunately, it is not as simple as forecasting forward an annual average price, much as we would like it to be, because it would make our job much easier if we could just say ‘we’re assuming an average of x%

price increase across the period’. But we’d be letting our clients down if we did that, because ARPU does not work in such a simplistic way.

It is instead shaped by: 1) price; 2) product mix; 3) free trials; 4) churn; 5) retention; 6) regions.

One of the most important, and sadly too often overlooked, components of ARPU is average subscriber months (ASM) i.e., how many months a year an average subscriber is subscribed. In a fast-growing market, ASM is lower as many of the subscribers at the end of the year were not subscribers at the start of the year. The inverse is true of mature markets.

Price increases have a direct impact on ASM because they affect retention (i.e., more people are likely to churn because of higher prices) and acquisition (i.e., fewer people are likely to subscribe because of higher prices). What is more, price increases have not had an equally proportionate impact on different tiers. Because price increases are often applied in full dollar amounts, the difference between cheaper tiers (e.g., Student Plan) and standard premium is narrowing, making those lower tiers less appealing.

Global ARPU is also shaped by regional shifts. For example, the price can go up by exactly the same proportion in Asia Pacific as North America, but if the former adds more subscribers than the latter, its overall lower average ARPU will pull down global ARPU.

This is why MIDiA’s ARPU model considers all these factors, as well as the potential impact of ‘super premium’. If we didn’t do this we’d end up with a bigger number, but not a better number.

If you like what you’ve seen so far, go check out the free summary report, and if you’re a client, go check out the full thing!

Pingback: MIDiA Global Music Projections 2024-2031: On the road to $100 Billion - Hypebot