What do Netflix and music subscriptions have in common? They both experienced slowing growth in 2014 in the US. Subscriptions are the monetization focal point of streaming but there have long been signs that the market opportunity is far short of the mainstream. Reports suggest that Spotify may (finally) be about to launch video, as a means of differentiating in an increasingly competitive marketplace that is about to get a whole lot more competitive on the 9th of June (i.e. when Apple announces its long mooted arrival into the space). Spotify needs a differentiation point. It may be the runaway market leader but it doesn’t have the feature badge of identity that many of its competitors do (e.g. Rdio is the social discovery service. TIDAL is the high def service. Beats is the curation service etc.). However, even with a feature differentiation point, Spotify and all of its subscription peers face a more substantial challenge than competing with each other: they are collectively in danger of banging their heads on the ceiling of demand for music subscriptions.

Behaviours Will Change, But Slowly

The world is unequivocally moving from ownership to access and streaming will be a central component of this new consumption and distribution paradigm. 9.99 subscriptions however have no such mainstream inevitability. They are too expensive for most consumers but most crucially they require consumers to pay for music every month when most people instead spend when one of their favourite artists is in cycle with a new album, single or tour. Over time (a half generation or so) some consumers will have their behaviours modified, but the majority will not. In some sophisticated markets (such as South Korea, the Nordics and, to some degree, the Netherlands) subscriptions are showing some sign of edging towards a wider audience (though still far short of mainstream). In most major music markets though, they remain firmly locked in single digital percentage adoption ranges. They are niche services for the high spending aficionados.

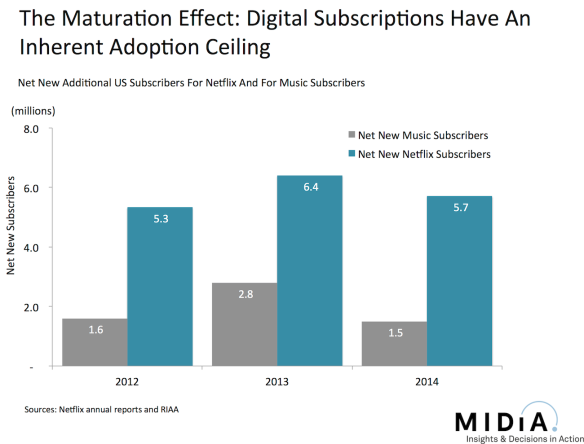

But this isn’t solely a music subscription problem. It is a dynamic of digital subscriptions more broadly. Take a look at the US. In 2014 net new subscribers (i.e. the amount of subscribers by which the market grew) fell to 1.5 million, down from 2.8 million in 2013 – which translated to a 46% decline in net adds. And that was in one of the highest profile years yet for subscriptions. Over the same time period, Netflix’s net new US subscriber growth fell from 6.4 million to 5.7 million, which was a more modest 11% decline in net adds.

This is not to say either business model has run its course – far from it, and of course both sectors still gee in 2014 – but instead that premium subscriptions are not mass market value propositions. And once you have mopped up your early adopters and early followers growth inherently slows. The music industry may be locked in an identity crisis over how it deals with freemium services, but it needs to have a realistic understanding of just how far subscription services can go without lower price tiers and more ability for users to easily dip in and out and, ideally, pay as they go rather than being tied to monthly commitments.

The incessant success of YouTube and Soundcloud show us that mainstream consumers want on-demand music experiences but the slow down of subscriber growth in the US shows us that the incumbent model only has a certain amount of potential. Sure, Apple will doubtlessly unlock a further tier of early followers to meaningfully grow the market, but it will only be a matter of time before it hits the same speed bumps.

Access based models are the mainstream future, subscriptions can be too, premium subscriptions though are not.

I don’t know about you, Mark, but it’s starting to get a little sad watching the industry stumble around in the dark trying to “solve” this problem. It was fun for a while as they tried to sue their customers, rally against iTunes, gouge their artists with 360 deals and now scramble around for scraps of revenue through streaming… But now it’s all looking a little pathetic, isn’t it? It’s such a shame to see an industry that was so hyper-focused on providing products that targeted the whims of consumers (“you like hair bands? Grunge? Boy bands? Well, here’s a shitload of them!”), that they’ve completely lost the plot now.

The truth is this: it’s not going to be any of these license-based models (streaming, iTunes) that’s going to “save” the music industry. It’s going to be an outsider: someone who tosses out the rules and doesn’t have to deal with the sunk costs of the past. It’s going to be someone that can successfully answer the question: “if there was never a music industry and we had to create one from scratch today. What would it look like?” And, like any successful business, you’d start by looking at what your potential customers want and need and create a business around that.

Unfortunately, the industry is still starting with: “what do I need and what can I sell that doesn’t canibalize my needs?” Hmmmph!

Schonne – I hear you. The positive side of this equation is that we are seeing the emergence of a new generation of companies that are playing by the new rules of the market and not wedded to the traditional model and the obsession with owning copyrights. In the UK more than half of indie labels started within the last 10 years which means they have only known digital. A sizeable number only started in the last 5 years which means they haven’t had time to get used to the sales mindset.

Consumer interest and demand is higher than ever. That is the crucial asset upon which the new business will be built.

@Mark I’d love to see a blog post from you examining these new indie labels and their viability in the marketplace, if you have the time. (LOVE the book, btw! I’m recommending it to everyone…)

Pingback: A Journal of Musical ThingsRandom Music News for Tuesday, May 12, 2015 - A Journal of Musical Things

Pingback: The Streaming Maturation Effect: What It Means For The Music Industry | South Carolina Music Guide

What is the fate awaiting the apps market? Less buyers?

Great shout Schonne – I’ll add it to the list of ‘blogs to write’. I’m still trying to get to my favourite title on the list ‘The Post-Cloud Apocalypse’ 🙂

And great to hear you’re enjoying the book. Thanks!

Roberto – the apps market is even more precarious. KING, GLU Mobile and Zynga all average around 1.5% free-to-paid conversion ratios and an average monthly spend per buyer of $21.55. Which may sound great but it means your fortunes are tied to the whims of a tiny bunch of irrational high spending gamers. That bubble will burst.

Christian Beats for Sale- Christian Beats For Sale , Intrumentals, drum kits.

Please Contact us

http://www.velbeats.com/

Thank you