Pandora continued its steady path towards subscriptions today with the announcement of a revamp of its premium radio offering Pandora One and confirmation of a forthcoming 9.99 tier. These of course have been in the works since its acquisition of Rdio’s assets back in November 2015. In the update Pandora One becomes Pandora Plus and gets new features including: ‘predictive offline playback’ for when signal drops, unlimited skips and unlimited replays. Pandora Plus may have a mid tier price point ($4.99) but it is not a mid priced subscription service, instead it is a premium priced radio service. This is not a revival of Rdio’s $3.99 Select offering nor is it a shot across Spotify and Apple’s bows. Nonetheless it is the start of a bolder streaming strategy for Pandora and it does raise the perennial issue of the case for mid priced subscriptions. Premium radio offerings like Pandora One Plus represent around 5 million subscribers in the US and are an important part of the market. But they are only the tip of the opportunity.

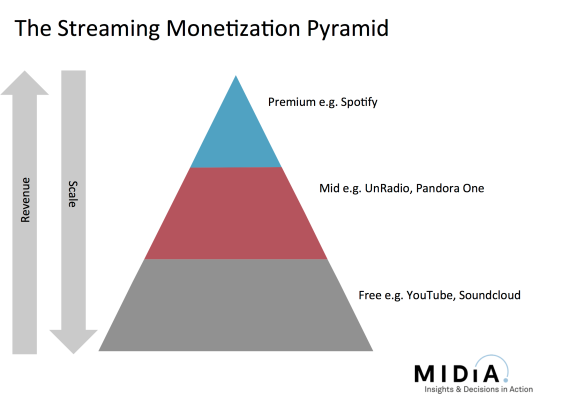

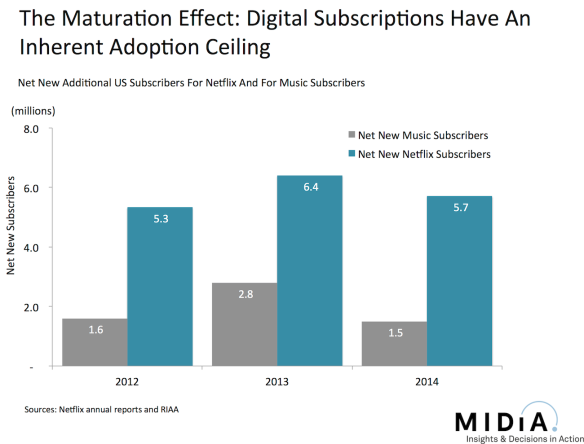

The case for mid priced subscriptions is clear: $9.99 is not a mainstream price point. It is fantastic value for music super fans, but more than mainstream fans are willing to pay. 9.99 subscriptions will continue to grow solidly for the next few years as the remaining untapped super fans are converted. But once that base is saturated the market needs something more, that’s where mid priced subscriptions come into play, helping unlock the next layer of consumers. Mid priced subscriptions can represent the best of both worlds, delivering large scale and premium revenue.

Mid Price Is No Easy Sell

However, the mid priced market is not without challenges, indeed, of the original wave of mid priced subscription services that came to market Blinkbox is gone, Cur Media is gone, Guvera is all but gone while Psonar and MusicQubed are still in market. The key challenges this market faces are:

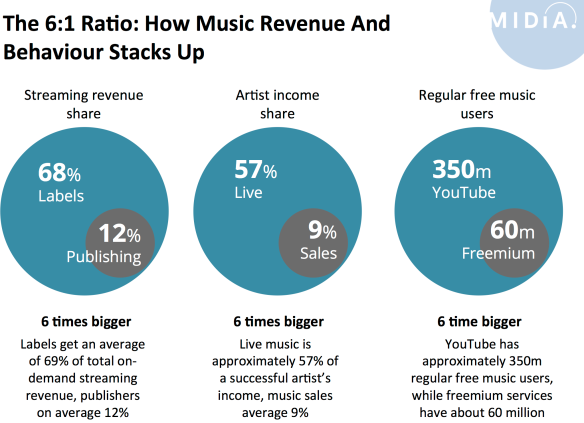

- It is not easy selling to mainstream consumers: mainstream consumers have less disposable income, are less engaged with music than super fans and are harder to convert

- It is hard to compete against free: while there are on demand free services in the market (YouTube, Vevo, Spotify free) it is hard for mid priced products to compete in value terms. These free services steal much of the oxygen out of the market. $1 for 3 month trials from Spotify and co only compounds this issue

- It is hard to differentiate: Label licensing constraints mean that the mid priced products deliver far less value than full priced products due to the restrictions imposed on them. Pandora’s INSERT gives the users 100 on demand tracks a month. That is 0.0003% of the 30 million on Spotify for 40% of the price of Spotify, or 1197% of the price of Spotify’s $1 for 3 months trial

Mid Tier Needs To Be Given More Substance

In short, the mid priced segment needs empowering with proper functionality. Mid tier products need more tracks and more on demand playback. Of course this has to be within clear bounds, else the risk of cannibalizing 9.99 tiers is to strong. But there are many other ways to do this rather than creating a painfully restrictive limit on the number tracks that can be played on demand. Here are some examples of how to differentiate mid tier while maintaining genuine user value by delivering more content and more choice in return:

- Windowed content only (e.g. a 4 week window on new releases)

- Limit on number of tracks that can be added to a playlist

- Genre specific subscriptions

- Strong focus on pushed playlists

- Cheaper pricing ($2.99 or $3.99 to reflect the changed marketplace)

For mid tier to work, the music industry needs to have the confidence that the $9.99 product is good enough to keep its core customer base, that these users will not jump ship for a product squarely aimed at the mainstream.

After a couple of years in the wilderness it looks like the marketplace is beginning to warm to mid tier once again. In addition to Pandora’s moves, Sony Music and Universal Music quietly launched the £5.99 Now Music app into the UK market earlier this year while MusicQubed’s MTV Trax has been getting large scale TV advertising support from Viacom. Meanwhile QQ Music and Apple Music are both driving scale in China with a price point equivalent to around $2.

$9.99 was always a blunt instrument, a sledgehammer to crack a nut. Now though, while $9.99 adoption is still growing, is the time to have a far more sophisticated approach to pricing. The safe option would be to wait until $9.99 growth slows. But by then it would be too late.