The impact of technology on the music business is well understood, but it is also having a dramatic impact on the music buying population, which in turn is changing the face of mainstream music. Digital music has so far been a journey for the more engaged, technology savvy music fan. Some of these have discovered free music, others a la carte, others streaming. All of these behaviours have eaten away at sales of the music industry’s core product: the album. Yet the CD album remains the music industry’s number 1 global music product and in key markets like Japan and Germany it accounts for approximately three quarters of sales. The problem of course is that CD buyers are steadily falling out of the market (10.5 million people have stopped buying music entirely in the UK and US since 2008). Though re-releases and discounted catalogue sales have helped bump up volumes in some markets, the net result is that new release album sales are dwindling. Even more interestingly though, the abandonment of the album by engaged music fans is changing the face of the top 10 (see figure).

Looking at how the US top 10 albums chart has evolved since 2000 reveals a few key trends:

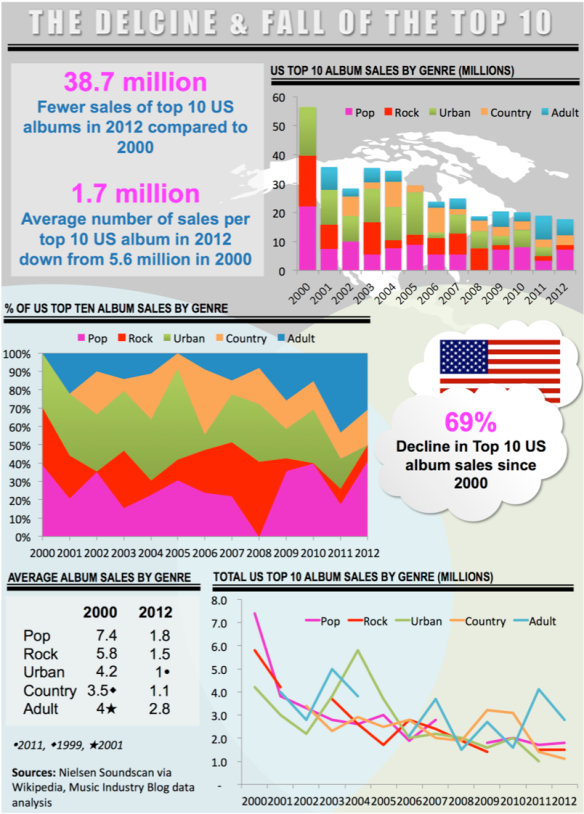

- Sales have tumbled sharply: the top 10 albums accounted for 56.4 million unit sales in 2000, by 2012 this had dropped by 38.7 million to 17.7 million (a 69% drop).

- Some genres have fared better than others: the average number of sales per top 10 album for Rock, Pop, and Urban all fell by 75% between 2000 and 2012. Country only fell by 66% and Adult by just 30%. Adult, with artists like Michael Bublé, Adele, Susan Boyle and Josh Groban represent the new ‘safe’ market for album sales. These artists appeal to older music buyers who still predominately buy CDs and often rely upon mainstream outlets like Walmart.

- Genres have fluctuated: although Pop is more pervasive than ever and now represents 41% of top 10 album sales, the sales for today’s Pop artists pale in comparison with those of the 2000 peak. One Direction’s 1.6 million and 1.3 million sales and Justin Bieber 1.3 million in 2012 compare miserably with ‘N Sync’s 9.9 million, Britney Spears’ 7.9 million and the Backstreet Boys’ 4.3 million in 2000. Urban has also steadily declined over the period, from a high of 50% of top 10 sales in 2005 to zero in 2012, while Country has steadily grown its share from zero in 2000 and 2001 to 19% in 2012. Rock, following a few strong years from 2006 to 2008 has been relegated to a niche of no more than 8% every year since, disappearing entirely in 2010.

Of course the top 10 album sales are not the whole music market, but that is sort of the point: the top 10 is becoming ever less of a measure of broader music buyer tastes and even further from the tastes of more engaged music fans. Streaming and a la carte are empowering the music aficionados to deep dive, if not into the long tail, then certainly into the full torso of music, bypassing the short head of the top 10. Leaving the top 10 as the pulse of the dwindling mainstream.