For our recently published MIDiA report ‘State of the Streaming Nation’ we conducted an exhaustive programme of research to assess the global streaming music market, from each of the consumer, market and service perspectives. In pulling together subscriber numbers for each of the music services (there’s a full table in the report) we found that there were 67.5 million subscribers globally in 2015. That was 24 million more subscribers compared to 2014 (also nearly double the number of new subscribers in 2014). It is clear that global subscriptions are gathering pace. However, all is not as it may at first appear:

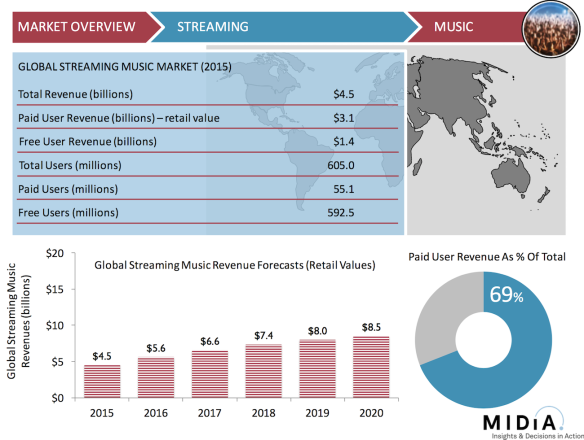

- Zombies still walk the streaming streets: Back in 2013 I ruffled a few feathers highlighting the issue of zombie subscribers, music subscribers that are recorded in the headline numbers but that are actually inactive, normally because they are on telco bundles. Fast forward to 2016 and the issue is more firmly in the public domain due to Deezer’s IPO filings. Zombies coupled with overstating by music services accounted for around 12 million subscribers in 2015 so the active ‘actual’ subscriber number was nearer 55 million.

- Emerging markets are gaining share: Emerging markets will play a key role for streaming over the next few years. They are already driving growth for Apple and Spotify and they will collectively bring the most dynamic growth with western markets nearing saturation for the 9.99 price point. Much of the growth though will come from indigenous companies, such QQ Music (China), KKBOX (Taiwan), MelOn (South Korea) and Saavn (India).

- Free still dominates: For all the scale of of subscriptions, free still leads the way with free streaming services accounted for nearly 600 million unique users (1.3 billion cumulative users if you add together the user counts of all the services). Free thus outweighed paid by a factor of 10-to-1.

Streaming’s Identity Crisis

Streaming must overcome its identity crisis. Depending on where you sit in the music industry, streaming is either the future of retail or the future of radio. It can be both, but there is increasing pressure for it to be retail only. That would see only a fraction of the opportunity realised. Throughout its history, a small share of people have accounted for the majority of spending. Casual buyers and radio accounted for the rest.

17% of music buyers account for 61% of spending. These are the people who are either already subscribers or that will become subscribers over the next couple of years. Which leaves us with the remaining 83% of consumers. The majority of these listen to radio while a growing minority use free streaming (mainly YouTube). The question the music industry must now answer is how seriously does it want to treat the opportunity represented by these consumers? Does it want to only serve its super fans or does it also want to be global culture? Radio enabled music to be global culture in the 20th century, free streaming will enable it to be in the 21st.

The Free Streaming Debate Is As Complex As It Is Nuanced

This is why the free streaming debate is important but also so complex. Yes, too much free music will curtail the opportunity for paid subscriptions, but too little could consign music culture to the margins. With streaming there is an opportunity to monetize a bigger audience at higher rates than radio ever enabled. At the moment free streaming bears the burden of being all about driving sales (either subscriptions or music purchases) but that misses the far bigger opportunity for free in the streaming era: mass monetization.

What we have now is a dysfunctional system. Freemium services have licensing minimas (the minimum that must be paid per stream) that effectively prevent them from building profitable ad supported businesses, while YouTube has licenses unlike any other but is the industry’s bête noire. Only Pandora has a model that is both (largely) acceptable to the industry and (theoretically) profitable. I say, ‘theoretically’ because Pandora could get towards a 20% margin if it wasn’t investing so heavily in ad sales infrastructure and other companies.

Out of those three disparate models an effective middle ground can and should be found so that the streaming debate becomes one of free AND paid rather than free VERSUS paid. Then we will have the foundations for creating a market that enables subscriptions to thrive within their niche and for global audiences to be monetized like never before.