Interim results are out for HMV, always a good litmus test for the state of music and media sales. I’m not a financial analyst so I’m not going to discuss the financial fundamentals, rather what this means for the music industry.

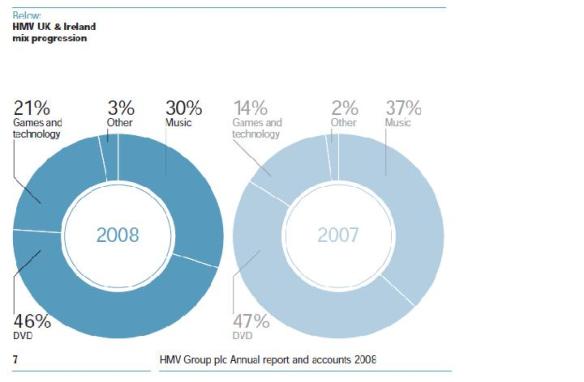

HMV stores sales (i.e. excluding Waterstones) are actually up over period. But technology and gaming, rather than music, have been key to this growth, increasing their combined share from 18 percent to 23 percent. HMV knows where its future lies. HMV is plotting a course that brings it closer to European peers such as Saturn in Germany and Fnac in France and Åhléns in Sweden: it is not just becoming much more than music, it is planning for a future when music will no longer be a core product. As you can from the chart below, music’s share of total sales is declining sharply and is strongly outweighed by DVD, which itself is now losing share to games and electronics.

So where does that leave music sales if Europe’s key high street music retailers are rapidly developing in other directions? It would be nice to say that this is part of a process towards strong online sales. But none of Europe’s major high street retailers have managed to steal any serious market share from Apple’s iTunes Music Store. They should have been able to, as they have the decades of music retailing and programming expertise that Apple is just learning. Selling in MP3 format is a crucial asset (which HMV now have) but they need to price as aggressively as Amazon is now in the UK and, most importantly, integrate heavily in store. This means that when you’re browsing the shelves in HMV you see most CD titles have offers for download discounts and bundles e.g. buy this album and get the other as a download for half price.

This might seem like a no-brainer, but it hasn’t happened because those responsible for in store CD sales are scared of accelerating cannibalization of their dwindling sales by driving people online. It’s too late for those kinds of concerns. The shift is already happening. All that’s left now is an opportunity for HMV to help drive the process rather than continue to be dragged along, losing customers and market share all along the way