An upfront note: though this post focuses on the UK market, the principles, as you will see, apply across most music markets.

At first glance the UK recorded music market isn’t in too bad shape: album sales declined by a not too worrying 5.6% in 2011 and digital grew solidly, including 26.6% growth in digital albums*. And of course there was Adele. So an end of term report card would probably read something like ‘Could do better but good signs of improvement’. Unfortunately that is a case of papering over the cracks. Here’s why:

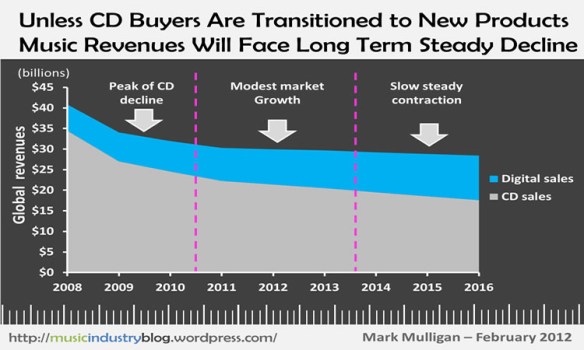

- CD sales are falling at an alarming rate: though digital album unit sales grew by 5.6 million, CD album sales fell by 12.3 million. So the digital growth was less than half of the physical decline in absolute terms. A worrying ratio at this stage in the development of the digital market (i.e. when it should be maturing, not just getting started).

- The single continues to drag revenue growth down. Digital singles boomed to 176.6 million, a whopping 56% greater volume than combined physical and digital albums. And yet their value is close to just a fifth of album revenues. Despite solid digital album growth, unit sales of digital singles increased by about 17 million, three times the units growth rate of digital albums. And though the spend increment is much greater for albums – and this is of course the lens labels will typically view the trend – the unit growth is the best indication of consumer behaviour. i.e. music buyers are still throwing their weight behind digital single purchases at a quicker rate than they are digital albums.

- The CD buyer is withering on the vine. Most importantly of all, the CD buyer is becoming an increasingly rare breed. There are fewer shops on the high street, which is where the majority of CD buyers still buy their albums. HMV – the UK’s leading music retailer by some distance – has been suffering well documented struggles. It is possible that HMV will disappear from the high street entirely in the next couple of years. Though this won’t be an extinction event for CD buyers, it will however leave a gaping hole in music revenues (possibly a quarter of all album sales). The majority of these Digital Refusniks who haven’t seen any reason to start buying CDs online – let alone downloads – are unlikely to suddenly switch even if they have to. More likely they will just drift out of the market entirely. These are the passive music fans who only buy the occasional album, don’t have an iPod, don’t want to spend £9.99 a month on music and who listen to a lot of radio. With so much more choice of high-ish quality music on digital radio and TV these consumers won’t even feel that much of a dent in their music behaviour when they no longer buy CDs.

- The CD is disappearing from the living room. I’ve been beating this drum for years now but still don’t get the sense the risk is being taking seriously. Living room tech spend has shifted firmly to the TV and music’s weakening foothold is either a docking station for the digital crowd, a streaming player for the really tech savvy or, in the vast majority of cases, a dusty old midi player which sooner or later is going to find itself in the bin or the garage. When that happens music will have disappeared out of the living room (and before anyone makes the case for music on the TV, that permanently relegates music not so much to poor relation status, as crazy aunt locked away in the attic. People buy TVs to watch stuff on them, not to have a blank screen while music plays on the poor quality speakers).

The Bottom Line

The music industry is being entrapped by a demographic pincer movement: on the left the emerging Digital Natives lack a product strategy that meets their needs, on the right the traditional CD buyers lack a format succession cycle. This is why the industry is becoming obsessed with squeezing as much ‘ARPU’ as it can out of the remaining core of 20 somethings and 30 somethings. But of course that strategy can only go so far. I’ve written at length about strategies for the Digital Natives, but the case for the Digital Refusniks is even more pressing, if less glamorous. The following needs to happen, and quickly:

- Digitize the relationship. Before an analogue customer base can be migrated to digital, the relationship with those customers must be digitized. In fact most HMV music customers have no relationship with HMV at all, or rather it is a series of brief encounters that start and finish with a cash till transaction. First HMV – and indeed high street music retailers anywhere – need to start finding a way to establish digital relationships with these customers and then use that as the platform for a digital revenue strategy. As my astute former colleague James McQuivey is fond of pointing out, Netflix built is success on the platform of digitizing its customer relationships. It is time for high street music retail strategy to follow suit. (And by the way, simply trying to push consumers to the online stores isn’t the answer).

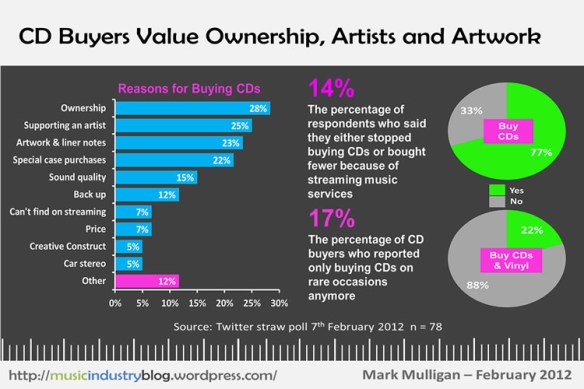

- A format succession strategy needs putting in place. The Digital Refusniks consumers need their hands holding as they are gently coaxed into the digital realm. They need convincing that the ephemeral web has tangible benefits comparable to that of the CD. That might mean delivering things like better artwork etc. but to get this right we need to know a lot more about the emotional triggers that CDs press for this consumers. A proper human needs assessment needs conducting, onto which a human-needs based product strategy can then be mapped. In all likelihood this will result in a couple of hybrid physical-digital products which will deliver all the benefits of CDs with a steady – but not overwhelming – stream of digital content to allow digital to ‘show some leg’.

- A new beachhead in the living room. As I proposed 4 years ago, the music industry (principally the label and retailer elements) need a new living room strategy which should take the form of a new piece of highly affordable Hi-Fi equipment. While its encouraging to hear that Google looks set to build upon the fine work of Sonos with some streaming music kit, the Digital Refusniks specifically need a hybrid device i.e. one that plays CDs too. Something that looks contemporary enough to warrant replacing the old midi system and is cheap enough to shift millions of units. You’ve probably guessed by now that this will need to follow an Amazon Fire approach of loss leading on the hardware to establish the Trojan horse for content sales. But it is an investment that will pay off.

The Digital Refusniks are a challenging and unfashionable demographic and the counter-case for addressing them is that in 10 years or so they’ll have disappeared from the market anyway. My conservative estimates put the loss in the region of 15% to 20% less total UK recorded music revenue in 2016. The industry may well be able survive its revenue forecasts being that much smaller, but a) does it want to? and b) HMV can’t.

*All sales numbers are BPI trade values. You can see the complete BPI release here: